How do you start your mortgage loan officer career?

What are the specific requirements in Minnesota?

We’re here to give you all the details.

With this, you’ll know EXACTLY what you need to do —- from start to finish.

So are you ready for your complete guide on how to become a mortgage loan officer (MLO) in Minnesota?

Let’s jump right to it!

How to Become an MLO in Minnesota – The 6 Steps to Getting Licensed

Here’s a rundown of the 6 steps to getting licensed as an MLO in Minnesota:

- Create an account with NMLS

- Complete pre-licensure education

- Pass the SAFE MLO test

- Undergo a federal background check

- Complete your MLO application

- Find a sponsor

Let’s get into the details.

Step #1: Create an Account with NMLS

To kickstart the process, you’ll need an account with the National Mortgage Licensing System (NMLS).

The NMLS manages the MLO application, examination, and certification across the US.

Now, you need to create an account first to get your unique number identifier – which you’ll be using throughout your application and career.

So here’s how to create an account with NMLS:

- Go to the NMLS Login Page.

- Request an account.

- Choose the ‘individual’ account option.

- Fill out the account form with your personal information such as your name, address, and any experience you may have.

- Follow the on-screen prompts.

- Receive your ID number and login in through email.

It’s as simple as that.

Step #2: Complete Pre-Licensure Education

For your education, you only need to complete 20 hours of pre-licensure education (also called PE).

The course should include:

- 3 hours of Federal Law and Regulation

- 3 hours of Ethics, including instruction on fraud, consumer protection, and fair lending issues

- 2 hours of training on lending standards for non-traditional mortgages

- 12 hours of electives

Don’t know where to take these courses?

Here are some top recommendations:

And here you can find a full list of approved PE providers.

NOTE: You don’t need to complete your PE before taking the SAFE MLO test. However, most people prefer to finish the courses first so they have adequate knowledge to ACE the test.

Step #3: Take the SAFE MLO Test

Are you ready to put your knowledge to the test?

In Minnesota, you will have to take and pass the National Component with Uniform State Content of the SAFE MLO test.

Here is how to register for the test:

- Log on to your NMLS account.

- Create a test enrollment window for your National Component with Uniform State Content > SAFE MLO test.

- Accept the Candidate Test Security and Confidential Agreement.

- Pay the $110 fee on the invoice page.

And here is how to schedule the test:

- In your NMLS account, select ‘Manage Test Appointment’.

OR

- Go to the Prometric scheduling page

- Schedule an online or in-person SAFE MLO test appointment

- Read through Prometric’s information review

What can you expect from the test?

Well, it’s made up of 120 multiple-choice questions that you’ll have to answer within 190 minutes.

That said, only 115 questions are graded —- the remaining 5 are simply sample questions.

What’s more, the questions are divided into:

- Federal Mortgage-Related Laws – 24%

- Uniform State Content – 11%

- General Mortgage Knowledge – 20%

- Mortgage Loan Origination Activities – 27%

- Ethics – 18%

To pass the test, you’ll need a minimum score of 75%.

Step #4: Undergo a Federal Background Check

Part of your MLO application process is to undergo an FBI criminal history check.

The good news is that this can all be done through NMLS.

Here’s what to do:

- Log back on to your NMLS account.

- Select the “Filing” tab.

- Click on “Criminal Background Check”.

- Choose to submit new prints – unless you already have existing prints with the NMLS.

- Provide all requested information.

- Attest authorization.

- Pay the $36.25 fee.

- Go to Fieldprint and schedule a fingerprinting.

- Have your fingerprints taken and wait for them to be submitted to the NMLS.

If you’ve committed a felony offense in the last 7 years, your MLO application may be banned.

If this is your case, you may upload a Commissioner Criminal Conviction Consent Application to the NMLS.

However, the SAFE Act views financial crimes (such as bribery, fraud, and checks forgery) much more seriously — resulting in permanent disqualification.

Step #5: Complete Your MLO Application

It’s time to finish your MLO application.

This means you have to complete and submit the Individual Form (MU4) — this will be your application form.

Here’s how to do that:

- Go to your NMLS account.

- Select the Filing tab and Request New/Update.

- Click ‘Add’ and select your state of residency and any other state you would like to work in.

- Choose the type of license you’re applying for.

- Fill up all the informational details.

- Answer the disclosure questions – and provide any necessary items if you answer ‘yes’.

- Pay the fees:

- NMLS initial licensing process – $30

- MN application fee – $90

NOTE: The Minnesota Department of Commerce does NOT issue paper MLO licenses. You can verify your certification through the NMLS’ Individual Form (MU4) filing.

Besides that, you will also have to authorize a credit report.

Here’s how:

- On your NMLS account, go to ‘Filing’ > ‘Individual’ > Request New/Update.

- Select ‘Credit Report Request’

- Follow the on-screen prompts

- Turn the Completeness Check icon on.

- Go through the Identity Verification Process (IDV) in the Individual Form (MU4).

- Agree to the TransUnion Smartmove Service Agreement

- Attest authorization.

- Pay the $15 fee.

While you don’t have to worry about a high credit score — a poor score may see your application process stalled.

If so, you will need to upload a credit report explanation. This is a detailed letter on proof of payoff, payment arrangements, evidence of payment, etc.

Step #6: Find a Sponsor

You’re almost done!

The last thing you need to do is find employment.

And remember, your license is still inactive if a sponsor (or employee) does not request sponsorship.

So go out and start looking for a job.

Don’t rush.

You need to make sure that you’re satisfied with the offers.

Once you do find the perfect match, have your new employee request sponsorship for you through NMLS.

The MN Department of Commerce will view the request and either accept or decline it.

If accepted, then your license will turn ‘active’.

And you can now start practicing as an MLO in the state.

CONGRATS!

Frequently Asked Questions About MLOs in Minnesota

How Much Does an MLO Earn in Minnesota?

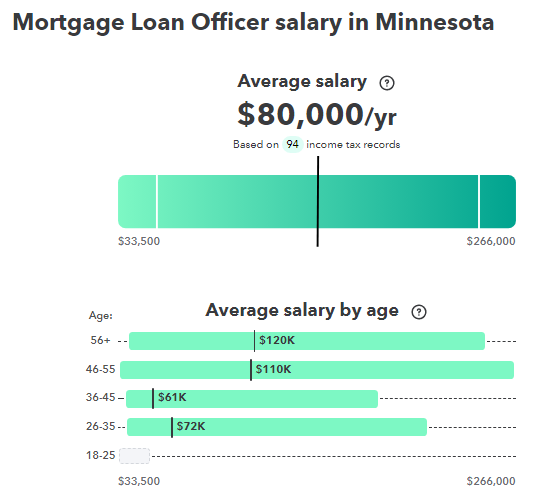

According to Mint, MLOs can expect a sizeable annual income of $80,000 annually in Minnesota.

However, you could earn more or less depending on the firm you work with, the amount of work that comes your way, and so many other factors.

Check out this chart below:

Source: mint.intuit.com

What Does a Mortgage Loan Officer Do?

Mortgage loan officers or originators have the important job of handling mortgage applications, checking if applicants qualify for a loan, verifying financial documents, and so much more.

MLOs are usually there from the start to finish of a mortgage loan.

Where Do Mortgage Loan Officers Work?

For the most part, MLOs work in commercial banks, credit unions, mortgage companies, and any other financial institute.

This can either be a full-blown, full-time job or just a couple of hours every week.

Conclusion

So those were the 6 steps on how to become a mortgage loan officer (MLO) in Minnesota.

When you consider other real estate careers, becoming an MLO seems like a breeze.

And it is.

But you still have to put a lot of effort and time into it.

But now that you have all the steps, it will be so much easier to get started.

Go ahead and start today!

Best of luck!